The margin requirement on a stock purchase is 25 ie you can borrow from your broker 75 of the purchase. If the price drops to 22 what is your percentage loss.

Margin Requirements Initial Maintenance Margin Requirements

Stock is trading at 25 and we buy 100 shares.

. We review their content and use your feedback to keep the quality high. 100 3 ratings 35 Margin required is 25. Your broker can require a higher initial margin and higher maintenance margin.

Margin accounts require a minimum of 2000 in net worth to establish a. Number of shares100 shares. Actual amount at which shares are bought02525100 Actual amount at which shares are bought625.

You fully use the margin allowed to purchase 100 shares of MSFT at 25. The margin requirement on a stock purchase is 25. It can be further broken down into Initial Margin Requirement and Maintenance Margin Requirement.

You fully use the margin allowed to purchase 100 shares of MSFT at 25. You fully use the margin allowed to purchase 100 shares of MSFT at 25. The margin requirement on a stock purchase is 25.

The margin requirement on a stock purchase is 25. IPOs generally provide superior long-term performance as compared to other stocks. If the price drops to 22 what is your percentage loss.

The margin requirement on a stock purchase is 25. Afterward Federal Reserve Regulation T requires maintenance margin requirements of at least. You fully use the margin allowed to purchase 100 shares of MSFT at 25.

So if you wanted to buy 10000 of ABC stock on margin you would first need to deposit 5000 or have equity equal to 5000 in your account. You fully use the allowed margin to purchase 100 shares of MSFT at 25. You fully use the margin allowed to purchase 100 shares of MSFT at 25.

Who are the experts. The margin requirement on a stock purchase is 25. The rules require you to have at least 25 percent of the total market value of the securities in your margin account at all times.

Stock exchanges require a minimum 2000 investment for opening any margin account but brokerages can require a. If the price drops to 22 what is your percentage loss. For new purchases the initial Regulation T margin requirement is 50 of the total purchase amount.

You fully use the margin allowed to purchase 100 shares of MSFT at 25. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors. The equity worth of your stock satisfies this requirement if the current market value of your stock exceeds 25 percent of your original purchase price.

If the price increases to 30 what is your percentage gain. The margin requirement on a stock purchase 25. If the price drops to 22 what is your percentage loss.

A Margin Requirement is the percentage of marginable securities that an investor must pay for with hisher own cash. If the price drops to 22 what is your percentage loss. The margin requirement on a stock purchase is 25.

Correct answer - The margin requirement on a stock purchase is 25. You fully use the margin allowed to purchase 100 shares of msft at 25. If the price drops to 22 what is your percentage loss.

Price of purchase25 share. Experts are tested by Chegg as specialists in their subject area. The margin requirement on a stock purchase is 25.

The equity in your account is the value of your securities less how much you owe to your brokerage firm. Open an IBKR account with no added spreads markups account minimum or inactivity fee. You fully use the margin allowed to purchase 100 shares of MSFT at 25.

The margin requirement on a stock purchase is 25. According to Regulation T of the Federal Reserve Board the Initial Margin requirement for stocks is 50 and the Maintenance Margin. Now since margin required is 25 we put in.

The margin requirement on a stock purchase is 25. You fully use the margin allowed to purchase 100 shares of MSFT at 25. You fully use the margin allowed to purchase 100 shares of msft at 25.

If the price drops to 22 what is your percentage lossAssume interest rate of borrowing is 0. You fully use the margin allowed to purchase 100 shares of MSFT at 25. You fully use the margin allowed to purchase 100 shares of MSFT at 25.

If the price drops to 22 what is your percentage loss. Regardless federal regulations only allow investing borrowers to borrow up to 50 of the total cost of any purchase as the initial margin requirement. So total cost of 100 shares is 2500.

Correct answer to the question The margin requirement on a stock purchase is 25. The margin requirement on a stock purchase is 25.

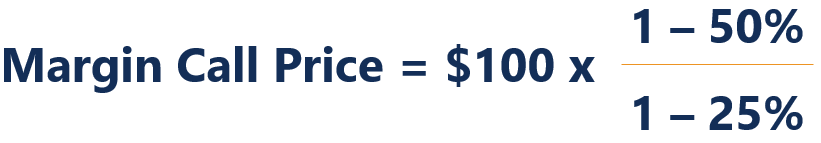

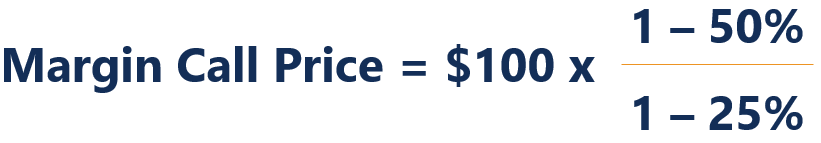

Margin Call Overview Formula How To Cover Margin Calls

Cash Account Vs Margin Account What Is The Difference Short Term Loans Investment Firms Accounting

0 Comments